Forex, also known as Forex and FX, refers to exchanging one currency for another. EUR / USD (Euro USD), USD / JPY (US Dollar Japanese Yen), GBP / USD (UK Pound US Dollar). Unfortunately, it’s not always that simple and can sometimes be very complicated. Therefore, it is important to be familiar with some of the common terms used in the forex world before considering trading currency pairs. Understanding these terms is the first step in developing your trading strategy.

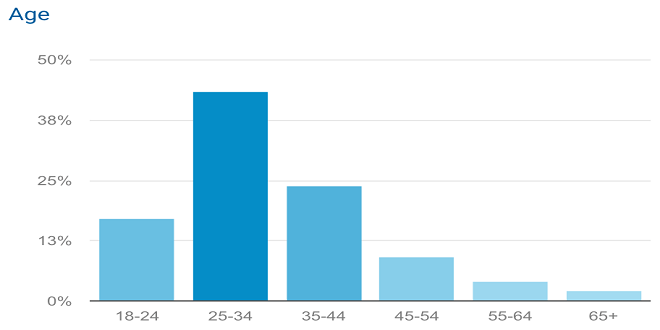

Here are some trading statistics everyone should know;

Yield

Yield refers to the rate of return on investment and is expressed as a percentage.

Using these basic Forex trading concepts, you can even start your journey into investing in the Forex market. Given the great potential offered by the Forex market, all you need to do is research, prepare, and open a Demand and trading account with a trusted brokerage firm to start investing.Here is a ctrader review for our readers interested in learning more about Forex.

Leverage

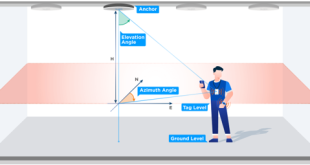

Forex leverage is a way for traders to borrow capital to gain greater exposure to the forex market. With limited capital, they can control a larger trade scale. This is based on the full amount of the position and can result in greater profits and losses.

Trading Forex Leverage, also known as Forex Margin, means that you can increase your profits when the market moves in your favor. However, if the market opposes you, you may lose all your capital. This is because profits and losses are based on the total amount of the transaction, not just the deposit amount.

Equity

Equity (Forex market) refers to the number of shares in a company. As an investor, when you buy a stock in a company, you buy the corresponding shares in that company. On the Forex exchange, the stocks of these companies are bought and sold by one investor to another. The word “share” is synonymous with the word “equity.”

Spread

There is always a difference between the price the seller wants the item and the buyer’s willingness to pay for it. There is a difference between the bid price and the asking price in the Forex market, and the bid price is generally lower than the asking price. This difference is known as the spread, primarily determined by supply and demand.

Bid

A bid is a maximum amount that a potential buyer of a stock willingly pays for its share of the stock. If there are multiple buyers in a share, and one buyer cannot or does not bid on the other, the bid between the buyers will end.

Trading account

Currently, the Forex market is computerized, so traders need to open an online trading account with a registered broker to execute transactions electronically. All orders to buy or sell are placed through this trading account. Moreover, you should also know about lot size in forex.

Bottom line

There are a lot of things related to the Forex market. If you are serious about investing and earning a profit, it is important to educate yourself about the important Forex market terms and statistics.