When blockchain technology was first developed, it was intended to function as a standalone system with a permanent digital record of all transactions, which could include other features such as support for smart contracts.

But innovation has gone one step further by creating a system that allows users to quickly transfer their assets between blockchains to take advantage of the unique advantages of each, providing the essence of today’s interchain bridging.

Increased liquidity and DeFi-related activities are enabled by cross-chain bridging, which allows users to transfer assets between blockchains.

For example, Bitcoin provides users with a safer and more stable environment for storing cryptocurrencies and trading pairs such as APT USDT that can be traded against other currencies, but moving values onto the Ethereum blockchain allows users to benefit from smart contracts that established in this environment.

This essay will define cross-chain bridges, explain how they work, and evaluate their safety for both novice and experienced investors. Let’s go!

Introduction to Cross Chain Bridges

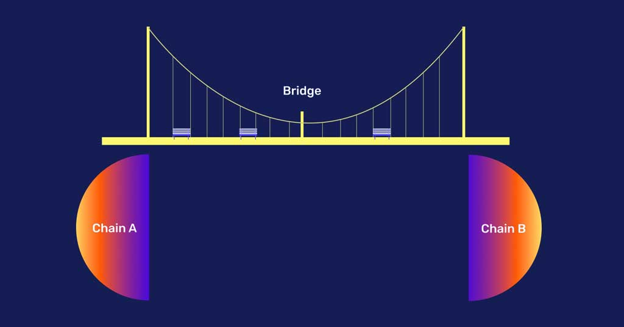

Software programs called “inter-chain bridges” allow transactions to take place between different blockchains. Cross-chain bridges are a crucial component of the process when someone wants to transfer cryptocurrency, non-fungible tokens (NFTs), or other digital assets between blockchain networks.

Since each blockchain works in isolation and cannot communicate with other blockchains, bridges are required between them.In contrast, older systems, such as banking, allow many providers to accept your credit card.

How do cross-chain bridges work properly?

A cross-chain bridge helped solve the problem by providing an easier way to move funds between different networks. To achieve this, many cross-chain bridges involved locking or burning crypto assets on the original chain via a smart contract and unlocking or minting new tokens on the new chain.

I could tokenize Bitcoin into Ethereum and use them on the Ethereum network if there were a cross-chain bridge. The tokens are locked in a smart contract for this purpose, creating native assets that can be used on another blockchain of the user’s choice.

Blockchain bridges come in three different flavors:

Fire and mint

On the original chain, users can burn their cryptocurrency holdings and create an identical amount of new assets on another chain.

Lock and mint

the ability to mint promissory notes on one chain while crypto assets are locked on another. On the other hand, to unlock the original assets in the first chain, he or she could burn wrapped tokens in the target chain.

Lock and Unlock

Through a liquidity pool, a user can lock cryptocurrency assets on one chain and unlock the same assets on another chain.

Why is a cross-chain bridge essential?

Understanding the relevance of interoperability in traditional finance is important to understanding how cross-chain bridging will enable smooth transactions in the cryptocurrency world. Blockchain bridges reduce transaction costs and improve the user experience.

It has been shown that one of the main obstacles to the widespread adoption of cryptocurrencies is the lack of interoperability between different blockchain.

Cross-chain bridging and related solutions are a significant step towards broader use of blockchain technology.

Users have the opportunity to benefit from the best aspects of two blockchains, including cheaper gas costs, better transaction performance and more utility in the form of DApps.

Two types of cross chain bridges

Cross Chain Bridges allow users to leverage the best properties of two different blockchains, namely:

Trust-based bridging

A trust-based bridge is a method of transferring bitcoins that relies on users’ trust in a “federation” or “custodial bridge” that is centralized in nature and requires a federation of individuals or intermediaries to function.

Bridges without Trust

In contrast, trustless bridges are based on smart contracts, making them inherently decentralized.

They work like true blockchains with individual networks that contribute to translation validation and also provide better security on translations compared to previous ones.

The Advantages of Cryptographic Bridges

Increase asset productivity

Users can use different platforms on different networks thanks to crypto bridges. Another great application of crypto bridges is using NFTs as collateral for different chains.

Improve user experience

In recent years, the cryptosphere has become much friendlier. Since the conversion process would be intimidating without this feature, the ability to connect one’s assets across multiple strings is an important component.

Final comments

Cross-Chain Bridges is a cryptocurrency and digital asset management tool that could greatly enhance the capabilities of blockchains, cryptocurrencies, and trading pairs like Solana USDT. You can transfer assets between multiple networks quickly and efficiently.

Since the blockchain industry is still in its infancy, great efforts should be made to strengthen smart contracts, improve inter-chain bridges connecting different blockchains, and make inter-chain bridges fully trustworthy.