A personal loan can be a great way to get the money you need to finance a big purchase or cover an unexpected expense. But before you apply for a personal loan, it’s important to make sure you are eligible.

There are a few things you’ll need to know before you can apply for a personal loan. First, you’ll need to know your credit score. Your credit score is a number that lenders use to measure your creditworthiness. The higher your credit score, the more likely you are to be approved for a loan.

If your credit score is not as high as you would like it to be, don’t worry. There are other things lenders look at when approving loans, such as your income and your debt-to-income ratio.

If you are unsure whether you are eligible for a personal loan, you should always speak to a lender. Lenders can help you understand your credit score and what you need to do to improve it. They can also give you advice on the best loan products for your needs.

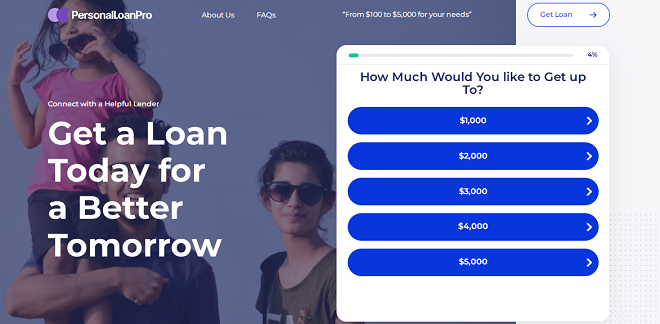

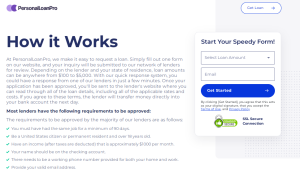

So, if you are thinking of applying for a personal loan, via this webpage of Personal Loan Pro you can easily find the eligibility criteria of different lenders, get offers from different lenders and compare them. Just be sure to do your research and understand what you need to do to improve your eligibility.

Advantages And Disadvantages Of Getting Personal Loans

When you are in need of money and don’t want to borrow from family or friends, you may consider getting a personal loan. There are both advantages and disadvantages to getting personal loans.

● Advantages

One of the advantages of getting a personal loan is that you can get a large amount of money relatively quickly. This can be helpful if you need to pay for a large expense, such as a car or a home. Additionally, personal loans often have lower interest rates than credit cards.

● Disadvantages

However, there are also some disadvantages to getting personal loans. One of the biggest is that you may be charged a higher interest rate if you have a bad credit score. Additionally, you will likely have to pay back the loan over a longer period of time than you would with a credit card. This can lead to you paying more in interest overall.

Before you decide whether or not to get a personal loan, it’s important to weigh the pros and cons. If you decide that a personal loan is a right option for you, be sure to compare interest rates from different lenders to get the best deal.

What Is The Best Site To Find Online Personal Loans?

When it comes to getting a personal loan, you want to make sure you are getting the best deal possible, so you can get more details about personal loans at Personal Loan Pro. There are a lot of lenders out there, and it can be hard to determine which one is the best for you.

That’s where online personal loan sites like Personal Loan Pro come in. Personal Loan Pro can help you compare the rates and terms of different personal loans so that you can find the one that is right for you. But not all online personal loan sites are created equal. So how do you know which site is the best for you? Here are a few things to look for:

- First, make sure the site is reputable. You want to make sure you’re dealing with a company that will be there for you when you need them.

- Second, compare the rates and terms offered by different lenders. This will help you find the best deal possible.

- Finally, make sure the site is easy to use. You don’t want to spend hours trying to find the right loan.

Personal Loan Pro is one of the most popular online personal loan sites. They offer a wide range of loans from a variety of different lenders, so you can compare rates and terms and find the best deal for you.

What To Do If You Can Not Get Approval For Personal Loans?

There are a few things you can do if you are experiencing difficulty in getting approval for a personal loan.

- You may want to consider a secured loan or a loan from a friend or family member.

- Another option is to look into a credit union, which may have looser lending requirements than a traditional bank.

- You can also try to improve your credit score by paying your bills on time and maintaining a good credit history.

Whatever you do, don’t give up on your quest for a personal loan. There are a variety of lenders out there who are willing to work with borrowers of all credit levels.