When we think of applying for a personal loan, the first place we think of is a bank which can offer us the loan, but honestly, banks are not the best place to apply for a personal loan. They seek for high credit and income requirements to qualify you for the loan eligibility.

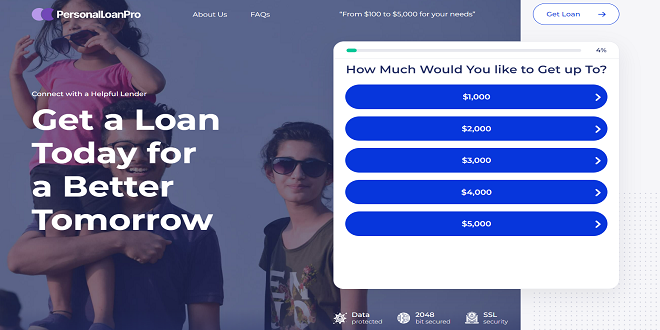

On the other hand, opting for the best no credit checking personal loan service provider – Personal Loan Pro is your best bet as it is both convenient and faster than conventional methods. Personal Loan pro has emerged as the preferred choice for borrowers who are in an immediate need of funds without much paperwork. Their user-friendly interface makes it simpler for consumers to conveniently apply for a loan digitally and connect with their network of reliable lenders.

How Personal Loan Pro is Better than Others?

There are many other similar platforms outside; hence, you may wonder why is Personal Loan Pro the best. Here are a few reasons we prefer this platform far more than others.

1. They are Quick

We have noticed that the entire process, from loan application to receiving funds in your account, Personal Loan Pro, is much faster than its competitors. They claim to be one of the fastest personal loan service providers. You just fill out a form and connect to lenders ready to work with you; hence you can quickly secure a personal loan with their help.

2. They are Safe

Many similar websites claim to quickly help you secure a personal loan, but you should be vigilant. Many such sites are created to spread malware and viruses on your device and steal sensitive information like your bank account number. You should check if such sites are linked to certified providers. They may fake it by adding the needed logos, but if they are not linked to the certification pages, then you should be cautious. Do not give your personal and sensitive information to any such website without being 100% sure.

With Personal Loan Pro, you have no worries as a borrower as they are legit and have high-security encryption to secure your sensitive information and protect your privacy.

3. They are Convenient

When you try to take a loan from a bank, you will have to visit the bank several times to finish the documentation. The entire process may take days that too if the bank agrees to lend you a personal loan. On the other hand, Personal Loan Pro offers a user-friendly online interface where you need not step out of the house to apply for the loan and receive the amount in your account. Everything happens online, starting from filling out a simple form with your personal information. If you are looking for a quick and fast loan-securing option, get a personal loan from Personal Loan Pro today.

4. The Chances That your Application Gets Accepted is High

When you approach individual lenders, such as banks, you have to submit different applications to everyone, which is time-consuming. You may still not be able to secure a personal loan if none of them approves your application.

Personal Loan Pro has addressed this issue by giving you a common platform to approach reputed lenders. You do not have to submit multiple applications, but a single application needs to be filled out. This will be seen by several lenders. Hence, the chances of your loan application being approved are much higher. You may get offers from multiple lenders, which gives you the opportunity to select one that seems to be offering the personal loan on the best terms.

5. You Can Apply for Multiple Loans

At times, you may need to apply for another personal loan when you have already taken one previously. If the state law permits, you can still apply for a new personal loan via Personal Loan Pro. The application process is the same. You just need to make sure to tell your lender about your existing loan before agreeing to the terms of the loan.

6. They Can Offer Loan Extensions

If you are unable to repay the loan immediately and need some time to repay your loan, reach out to the lenders before missing out on payments, and they may permit extensions on your loan. Most lenders are willing to work with the borrowers so that you can avoid defaulting on the loan payment. Note that loan regulations on extensions or rollovers can vary between lenders and be constrained by state law.

7. They are Responsible Towards Their Consumers

Personal Loan Pro encourages the practice of fair lending laws and has full disclosure of terms mandatory by the lender. As per the Truth in Lending Act, the lender should disclose all loan fees and interest rates to the consumer. This should happen before you accept your loan. The details offered by the lender should include the exact fees, rates, rollover charges, and other details.

When you accept the terms offered by the lender, most of them will direct you to an e-signature page to complete the loan process. The consumer should take the time to read this loan agreement carefully and accept it only when they understand all the terms completely. If you agree to the terms offered by the lender, only then sign the agreement.

8. They Work Towards Maintaining Fair Lending

Personal Loan Pro not just connects you with lenders, but encourages them to follow applicable federal and state regulations. This also means lenders are asked to conform with the local laws when it comes to fees, interest rates, rollover limits, maximum loan terms, and cooling-off periods between loans.

Conclusion

If you are looking for an online personal loan service provider and unsure which one to choose, you can blindly trust Personal Loan Pro, as they offer the best benefits. However, before applying for the loan, ensure you know the personal loan qualification criteria most lenders require to be able to offer you a loan based on their terms. If you are eligible for a personal loan, then you just need to visit their website and fill out the loan application form to get started.